Golden Rules of Accounting- Rules of Debit and Credit Explained

Hey Guys, so today we will study the most important and interesting

topic of Accounts. Golden Rules of Accounting- Rules of Debit and

Credit which is the base of accounts and the language of accounts. Under double

entry system of Book keeping each transactions has two aspects. One is called

debit and another is credit where, debit records incoming or receiving aspect

and credit records outgoing or giving aspect.

Meaning of an Account

Account is a summarised record of transactions at one place related to

the particular head. Account is prepared for sort and store the transactions.

Each individual account is stored in the general ledger and used to prepare the

financial statements at the end of the accounting period. An Account shows

specific assets, liability, revenues, assets, equity.

An Account is divided into two parts which is known as Debit and Credit,

Debit and Credit are two opposing terms. Dr. is used for

Debit and Cr. stands for Credit, Debit refers to the

left side of an account and credit refers to the right side of an account. An

item recorded on the debit side of an account is said to be debited to the

account and when an item is recorded on the credit side of an account it is

said to be credited to the account. Debit and Credit are simply additions to or

subtractions from an account. An Account is usually in a "T" shaped

layout in which both Debit and credit aspects are recorded, let's have a look

below on how an account looks-

Debit and Credit

As

we know, Under Double Entry System of Book Keeping we records both the aspects of

any financial transaction. So, at the time of recording the transaction, it is

recorded once on a credit side and again on the credit side. A Double entry

system will maintain complete records and also gives proper financial results. Debit

aspect used for receiving or incoming aspect and credit aspect is used for

giving and outgoing aspect. Debit and Credit aspects of a transaction form the

basis of Double Entry System. We know this equation which is known as an

Accounting Equation:

Assets = Liabilities

+ Capital

👉Also Read International Financial Reporting Standards(IFRS) Explained

In the Dual aspect system of Accounting we get to

know that if there is any change on one side of the above equation, there will

be a change of similar amount on the other side of the equation or among the

items comprised in the same side of the equation. To get more information on

this, hit on the link Accounting Equation.

Debiting and crediting an account- we either debit

an account or credit an account in relation to an accounting transaction. Debit

and Credit are two actions that are opposite in nature, both debit and

credit may represent either increase or decrease depending upon the nature of

the account.

Classification of Accounts

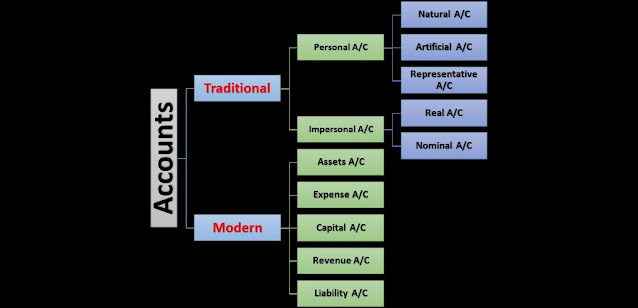

The below image help us to show the various

accounts classified according to their nature-

In the above image we get to know that there are

namely two types of approaches in accounts, one is from the view of

Traditional approach and another is from Modern approach. Traditional approach

classified into two accounts Personal account and Impersonal account, where

Personal account further holds three types of accounts(Natural account,

Artificial account and Representative account) and Impersonal account holds two

type of accounts(Real accounts and Nominal accounts) As per Modern

approach five type of accounts are prepared(Assets Account, Expense account,

Capital account, Revenue account and Liabilities account). Let we discuss all

these accounts one by one in detail.

Traditional Classification of Accounts

Personal Accounts

As the name suggests, these accounts are related

with Persons i.e, Individuals, drawings, companies, firms, debtors, creditors

etc. Examples of some personal accounts are account of Sohan Enterprises(a good

supplier), account of M/s salvy & co.(a credit customer). The purpose of

preparing these type of accounts is to ascertain the remaining balance due from

persons and orgainizations which are related to the business transactions.

Natural Personal Accounts- These accounts are related with natural persons, it

means persons which are creations of God, Like Rakesh's Account, Manoj's

Account, etc.

Artificial Personal Accounts- These accounts do not have a physical existence as

Natural Personal Accounts, they are recognized as persons in business in

business dealings. These are known as legal entities create by humans, for

example an account of a private limited company, a society, a

trust etc.

Representative Personal Accounts- Representative Personal accounts are those accounts

which which represent certain person or group of peoples. For example salaries

due to the employees, then outstanding salary account will be opened in the

books of accounts. The outstanding salary account shows that the amount of

salary payable to the employees.

Impersonal Accounts

Any account other than personal account such as

Furniture account, Electricity Bill account, cash account etc are termed as

Impersonal accounts.

Real Accounts- The accounts which are related to tangible or

intangible assets of the firm other than any person(debtor) is known as Real

accounts. For Example- Machinery, Furniture, Land, Goodwill, Trademark etc.

Nominal Accounts- Nominal accounts are associated with Income,

Expenses, Profits and Losses. The net result of all the nominal accounts is

profit or loss which is transferred to the capital account. Example of some

Nominal accounts are- Salary account, Sales account, Purchase account, Interest

paid account etc.

Modern Classification of Accounts

Assets Account- These

accounts are associated with account of assets and properties owned by the

company such as Machinery account, Plant account, Building account, Patents

account etc

Expense Account- The money

spent in the course of business or even lost while performing the business operations

are recorded under this account.For Example- Depreciation account, Rent

account, Staff welfare account etc

Capital Account- This is

related with the accounts of the owner(Proprietor/Partners) of the business who

invested money into the business. These accounts are Capital account of owner,

Capital account of partners, Drawings account etc.

Revenue Account- When a company

earns from the sale of their operations, then revenue is generated. Under

revenue accounts Income and gains of the business are recorded, like Sales,

interest received, Discount received etc.

Liability Account- These

accounts are that of in which company records its debts from lenders, Creditors

for goods, Outstanding payment for various expenses etc.

Golden Rules of Accounting

Accounting rules guide us how to record the

transactions in the books of accounts under Double Entry System of Accounting.

Accounting rules works as a base for any accounting framework. Accounting rules

are used uniformly by all entities to reach at the consistent and comparable

Financial Statements. Golden rules of accounting are the basic accounting rules

on the basis of which accounting entries are recorded.

👉Also Read Accounting Information System Explained

👉Also Read Cash and Accrual Basis of Accounting

Real Accounts

The rule related to real accounts states Debit is

what comes into the business and credit is what goes out from the business. It

means, if something comes into the business then it would be debited in the

books of accounts and if something goes out of business, it will be credited in

the books of accounts while recording.

For Example- A Machinery was purchased by Suhana Enterprises

in cash of Rs 8500/-. Now machinery is an asset and it comes into the business

and cash was paid on behalf of Machinery. So, as per real account, the

Machinery account was debited and Cash account was credited.

Journal Entry in the books of Suhana Enterprises-

Machinery Account

...Dr 8500

To

Cash Account

8500

Personal Accounts

The rule related to Personal

Account states Debit is the receiver and credit is the giver or say, if a

person receives something into the business, then receiver's account should be

debited and if a Person gives something in the business, then giver's account

shall be credited.

For Example- Mohit receives cash of Rs 15000/- from

Sohan for his pendings. In the books of Sohan, Mohit is the receiver of that

amount and Sohan is the giver. So, Mohit's account shall be debited and Sohan's

account shall be credited with cash.

Journal Entry in the books of Sohan-

Mohit's Account

..Dr 15000

To Cash

Account 15000

Nominal Accounts

The rule related to nominal account states that all

expenses and losses of the business are debited and all income and gains of the

business are credited.

For Example- ABC Ltd. paid salaries to their staff

Rs 1Lakh, then salary is an expense it should be debited. Discount received by

ABC Ltd. of Rs 15200/- is an income so it should be credited in the books of

accounts of ABC Ltd.

Journal Entry in the books of ABC Ltd.

Salary Account

..Dr 1,00,000

To

Cash/Bank Account

1,00,000

Cash/Bank Account ...Dr

15,200

To Discount Received Account

15,200

I hope guys you all understand the topic

of Golden Rules of Accounting- Rules of Debit and Credit which is the most

important topic of Accounting and interesting although. If you have any

questions or doubts regarding this post, then please tell me in the comment

section. Thanks for reading, have a nice day.

Comments

Post a Comment

Please do not enter any spam link in the comment box